All you need to know about Sydney’s light rail

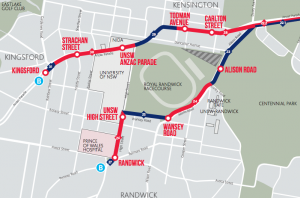

Construction on two new Sydney light rail lines servicing the CBD and south east suburbs of Sydney has commenced and is expected to be completed by the end of 2017. The lines will expand Sydney’s light rail network through the CBD and to Surry Hills, Moore Park, Randwick, Kensington and Kingsford. The line from Circular Quay to Moore Park will branch off at Anzac Parade near Dacey Road to form … Read more »